Price Betterment

A Price Betterment Algorithm is a smart order execution strategy that aims to get you a better price than the current market price when buying or selling. Instead of placing the entire order at once, the algo waits for small favorable price movements and executes only when the price is slightly better, helping reduce slippage and improve overall trade quality

When to Use?

Use it when you want a slightly better price than the current market, especially in stable and liquid stocks.

It helps reduce slippage and gives smoother execution for medium–large orders.

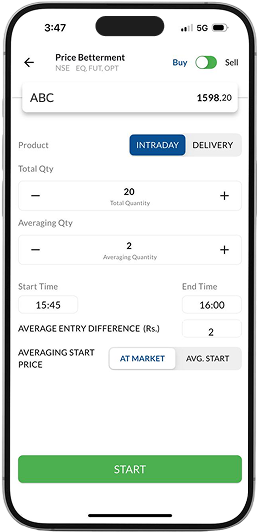

What are the inputs required?

Stock Name

This is the stock you want to buy or sell in Equity or F&O Segment

Total Quantity

This is the total quantity you want to buy/ sell

Start Time

This is the time when the algorithm will start executing

Start Price

Select Start price as At Market / Custom At Market: the first order is executed on market immediately

Custom: the first order is sent when the start price is reached

Action

This is the action you want to take (Buy / Sell)

Product Type

In Cash: Select from Intraday/ Delivery In F&O: Select from Intraday/ Normal

Averaging Quantity

This is the quantity that will be placed once the averaging conditions are met

End Time

This is the time when the algorithm will stop, even if the total quantity is not met

Averaging Entry Difference

This is the min drop in price wrt last reference price to trigger buy order

What are the inputs required?

1 Action

This is the action you want to take (Buy / Sell)

2Stock Name

This is the stock you want to buy or sell in Equity or F&O Segment

3 Product Type

In Cash: Select from Intraday/ Delivery

In F&O: Select from Intraday/ Normal

4 Total Quantity

This is the total quantity you want to buy/ sell

5 Averaging Quantity

This is the quantity which will be placed periodically till the algorithm stops

6 Start Time

This is the time when the algorithm will start executing

7End Time

This is the time when the algorithm will stop, even if the total quantity is not met

8Average Entry Difference

This is the min drop/ rise in price wrt Averaging reference price to trigger orders

9Start Price

Select Start price as At Market / Custom At Market: the first order is executed on market immediately

Custom: the first order is sent when the start price is reached

How does it work?

After the Algorithm is triggered it works in the following way:

If buying → it fills when the price dips.

This way, you get improved fill quality instead of hitting market orders.

When not to use?

Avoid it in highly volatile or fast-moving markets because waiting for better prices can result in missed or delayed fills.

Also not suitable for illiquid stocks or situations where you need immediate execution.