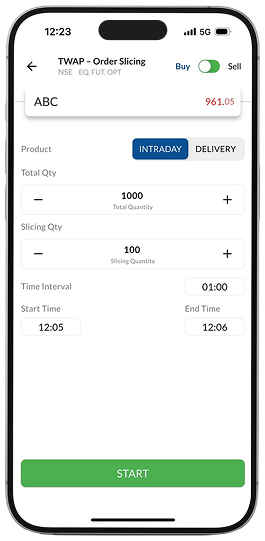

TWAP- Order Slicing

Time Weighted Average Price (TWAP) is a smart order execution strategy used to buy or sell a specified quantity of a security over a chosen time period. The total order is divided into smaller parts and executed gradually instead of placing one large order at once.

When To Use?

TWAP is ideal when you need to place a large order and are not focused on getting a specific price. By splitting the order into multiple smaller orders (called child orders), it helps reduce market impact and avoids sudden price movements. This approach ensures steady execution and balanced exposure over time, without the need for manual order placement.

What are the inputs required?

Stock Name

This is the stock you want to buy or sell in Equity or F&O Segment

Total Quantity

This is the total quantity you want to buy / sell

Slicing Quantity

This is the quantity which will be placed periodically till the algorithm stops

Start Time

This is the time when the algorithm will start executing

Action

This is the action you want to take (Buy / Sell)

Product Type

In Cash: Select from Intraday / Delivery

In F&O: Select from Intraday / Normal

Time Interval

This is the time difference you want to keep between two slices

End Time

This is the time when the algorithm will stop, even if the total quantity is not met

What are the inputs required?

1 Action

This is the action you want to take (Buy / Sell)

2Stock Name

This is the stock you want to buy or sell in Equity or F&O segment

3 Product Type

In Cash: Select from Intraday/ Delivery

In F&O: Select from Intraday/ Normal

4 Total Quantity

This is the total quantity you want to buy/ sell

5 Slicing Quantity

This is the quantity which will be placed periodically till the algorithm stops

6 Time Interval

This is the time difference you want to keep between two slices

7 Start Time

This is the time when the algorithm will start executing

8 End Time

This is the time when the algorithm will stop, even if the total quantity is not met

How does it work?

After the Algorithm is triggered it works in the following way:

As soon as the Start Time is reached, the first order is placed which is equal to the Slicing Quantity mentioned

The Algorithm keeps sending slices keeping a difference of Time interval between them

As soon as the Total Quantity is met or End Time is reached, the Algorithm stops.

When not to use?

This Algorithm is not suggested for illiquid stocks (i.e. high bid-ask spread or low volume traded). It is also not recommended for stocks having high volatility.