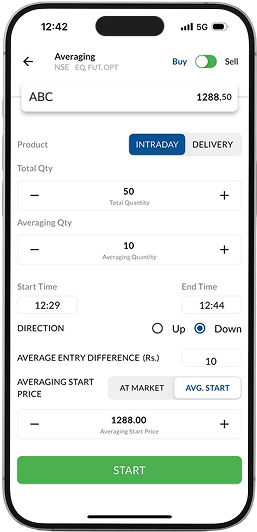

Averaging

This strategy is meant for investors who want to average their positions as the market moves by a predefined number of points in a chosen direction. If you have a clear market view and want to manage price fluctuations by gradually adjusting your buying or selling price, this strategy can help smooth out market volatility.

When To Use?

Averaging is effective in both upward and downward market conditions. In rising markets, it allows you to build positions gradually and benefit from continued momentum. In falling markets, it helps lower the overall average buying price, reducing the impact of short-term declines.

What are the inputs required?

Stock Name

This is the stock you want to buy or sell in Equity or F&O Segment

Total Quantity

This is the total quantity you want to buy / sell

Averaging Quantity

This is the quantity that will be placed once the averaging conditions are met

Start Time

This is the time when the algorithm will

start executing

Averaging Start Price

At Market : the first order is executed on market level immediately

At Average Start : the first order goes only when the average start price is reached

Action

This is the action you want to take (Buy / Sell)

Product Type

In Cash: Select from Intraday / Delivery

In F&O: Select from Intraday / Normal

End Time

This is the time when the algorithm will stop, even if the total quantity is not met

Direction

This is the desired direction in which you want the market to move

Average Entry Difference

This is the min drop/ rise in price wrt Averaging reference price to trigger orders

What are the inputs required?

1 Action

This is the action you want to take (Buy / Sell)

2Stock Name

This is the stock you want to buy or sell in Equity or F&O Segment

3 Product Type

In Cash: Select from Intraday/ Delivery

In F&O: Select from Intraday/ Normal

4 Total Quantity

This is the total quantity you want to buy/ sell

5 Averaging Quantity

This is the quantity which will be placed periodically till the algorithm stops

6 Start Time

This is the time when the algorithm will start executing

7 End Time

This is the time when the algorithm will stop, even if the total quantity is not met

8Direction

This is the desired direction in which you want the market to move

9Averaging Start Price

At Market: the first order is executed on market level immediately

At Average Start: the first order goes only when the average start price is reached

10Average Entry Difference

This is the min drop/ rise in price wrt Averaging reference price to trigger orders

How does it work?

After the Algorithm is triggered it works in the following way:

As soon as the Start Time is reached, the first order is placed on the basis of Averaging Start Price selected

- If at Market is selected, then the first order equal to the Averaging Quantity is placed immediately

- If at Average Start is selected, then Algo checks if the current market price is equal to the Averaging Start Price or in the same Direction as selected by the user. As soon as this condition is met, first order equal to the Averaging Quantity is placed

The Algorithm keeps on checking the parameters after every Time Interval and sends order slices accordingly

- the Last Traded Price difference wrt last executed price is equal to or greater than the Average Entry Difference

- the Last Traded Price is in the same Direction as mentioned by the user an order is placed equal to the Averaging Quantity

As soon as the Total Quantity is met or End Time is reached, the Algorithm stops

When not to use?

The stocks where the fundamentals of the company have worsened or potential of the company is in question, averaging down can bring excessive risk exposure too. Also, averaging up in a market not backed by fundamentals can lead to huge losses, if there is a correction just after the averaging up. Thus, the script selection is an important step.